The forex market presents a lucrative opportunity for businesses seeking to establish their own brokerage. While the industry itself is definitely promising, competition is fierce. Only those brokerages that implement smart business strategies and hold a strong infrastructure can take the lead.

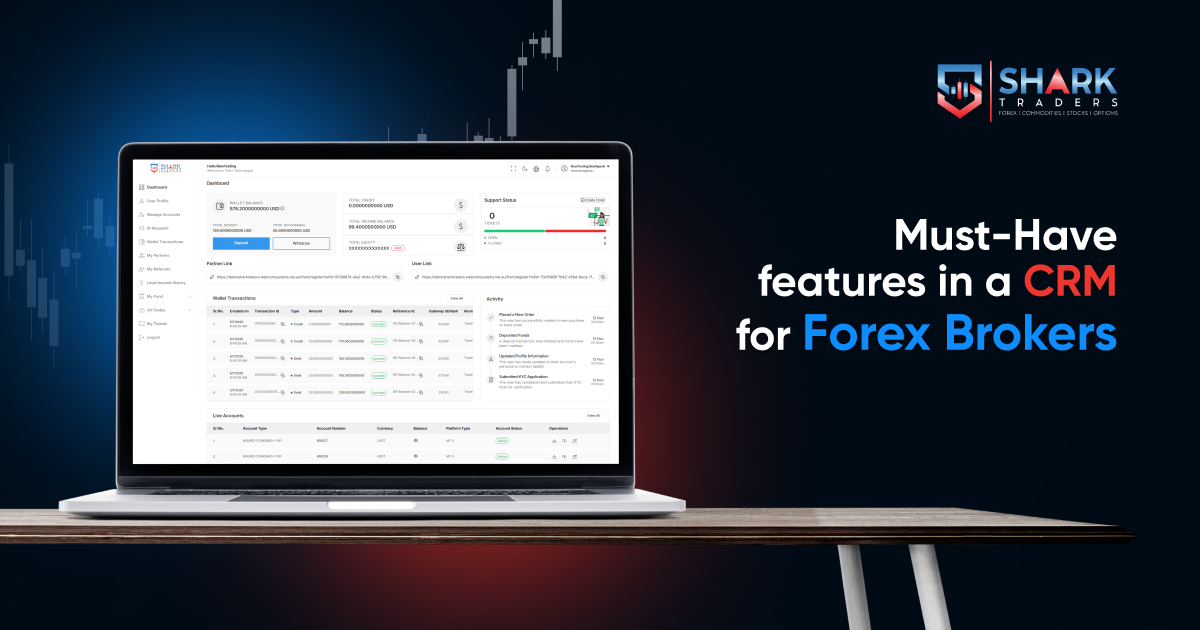

An FX CRM forms the backbone of a brokerage’s infrastructure, which is definitely a make-or-break element for a brokerage. Therefore, selecting a powerful forex CRM is vital for enterprises not only to compete effectively but also to operate efficiently. This highlights the key features that define an ideal Customer Relationship Management System for forex brokerages.

What Is A Forex CRM?

A Forex CRM (Customer Relationship Management) system is software built to help forex brokerages manage various aspects of their business operations. It covers managing client information, keeping track of accounts, monitoring general revenue, handling client communications, and streamlining business workflow.

Basically, an FX CRM system frees up businesses from the task of creating multiple spreadsheets for different tasks and constantly switching between them. This brokerage software consolidates everything into a single interface.

Thus, CRM presents an integrated approach that greatly benefits brokerage businesses in improving their customer relations and business operations and supporting overall decision-making.

Key Features Of An Ideal Forex CRM for Brokerages

Here are the main functionalities that a CRM must have in order to effectively assist brokerages:

Built-in IB Management System

IB programs are beneficial for the growth of brokerage businesses, yet very complex to manage. However, CRM can assist in building and managing multi-level IB structures quite easily!

Thus, a brokerage that aims to not only operate but also grow extensively requires a built-in IB and affiliate management feature in its CRM. It enables brokerages to handle a robust IB network within the CRM by providing functionalities such as commission calculation, automated payouts, commission tracking, performance auditing, and much more.

Thus, brokerage doesn’t have to invest in another third-party solution as the business grows and new IB partners connect. CRM’s unified interface can help by providing centralized control and seamless scaling of both business and relationships.

Advanced Analytics

A Customer Relationship Management (CRM) system collects data in a central location, analyzes it, and provides insights to brokerage firms. The advanced analytics feature of a CRM not only collects data from multiple sources but also examines and interprets it to predict client behaviors. Moreover, it monitors trading patterns and preferences, enabling firms to optimize their marketing efforts.

As a result, brokers no longer need to rely on old and basic marketing strategies. They can use real-time data to create solid client retention strategies that yield effective results.

Integration with Trading Platforms

Many new traders prefer using MT4 and MT5 trading platforms, so it’s important for a CRM to be compatible with these trading systems. However, some institutional traders and investors utilize a variety of advanced trading platforms. Therefore, businesses looking to serve clients of all experience levels and preferences should choose a CRM that supports multiple trading platforms. This gives access to real-time trade transaction statistics, trading activity, client turnover, and other data across several platforms.

KYC/AML Compliance

The forex market is a highly regulated sector that requires brokerages to comply with numerous regulations. Therefore, a CRM system functioning as the core medium to manage operations should be equipped with built-in tools for compliance with Know Your Customer (KYC), Anti-Money Laundering (AML), and other regulations.

A strong CRM includes automated KYC procedures, anti-money laundering audits, and sophisticated risk management tools. The platform would streamline the client onboarding by reviewing and verifying their user information and documents. It would look for any fraudulent activities and initiate the necessary actions when required.

An FX CRM ensures that the brokerage is operating legally in accordance with global standards and protecting user information. As a result, the risk of regulatory penalties is reduced while also maintaining market trust.

Mobile Functionality

In the era where mobile functionality has become an essential feature of every software application, CRM solutions are no exception. Many brokerage businesses operate remotely these days and don’t have access to massive systems to manage their CRM systems. With access to mobile devices, the team members can access the brokerage data from anywhere and at any time. Moreover, respond to queries of clients and IB partners even while traveling. Thus, even if the brokerage has a physical office, the team can remain productive when they are not on-site.

Automated Client Assistance

Automated chat tools and account management tools, which were considered as add-on features just a few months back, have become the most critical ones these days. It enables breakages to respond to client queries in real time, eliminating the need for a 24/7 active support team.

Final Thoughts

Therefor, forex brokerages must invest in high-quality CRM systems equipped with all the features discussed in this article to fully leverage the benefits of a centralized solution. While many CRM solution providers exist in the market, only a selected few offer the complete range of necessary features in their CRM systems, often leaving out critical elements.

Shark Technologies is the leading fintech service provider that has especially built robust CRM systems for forex brokerages, fitting every single feature from lead management, client management, compliance, security protocols, and much more. Our team can even incorporate the required custom features as per the brokerage’s needs, industry standards, and business model. Book a demo today.

Also Read : The Evolution of Forex Trading Platforms in 2025